A new report from Canalys has revealed what the world's two largest cloud providers have been up to – and they've certainly been busy.

Both Amazon Web Services (AWS) and Microsoft Azure saw strong growth in Q4 2018 as the adoption of cloud infrastructure services is showing no signs of slowing.

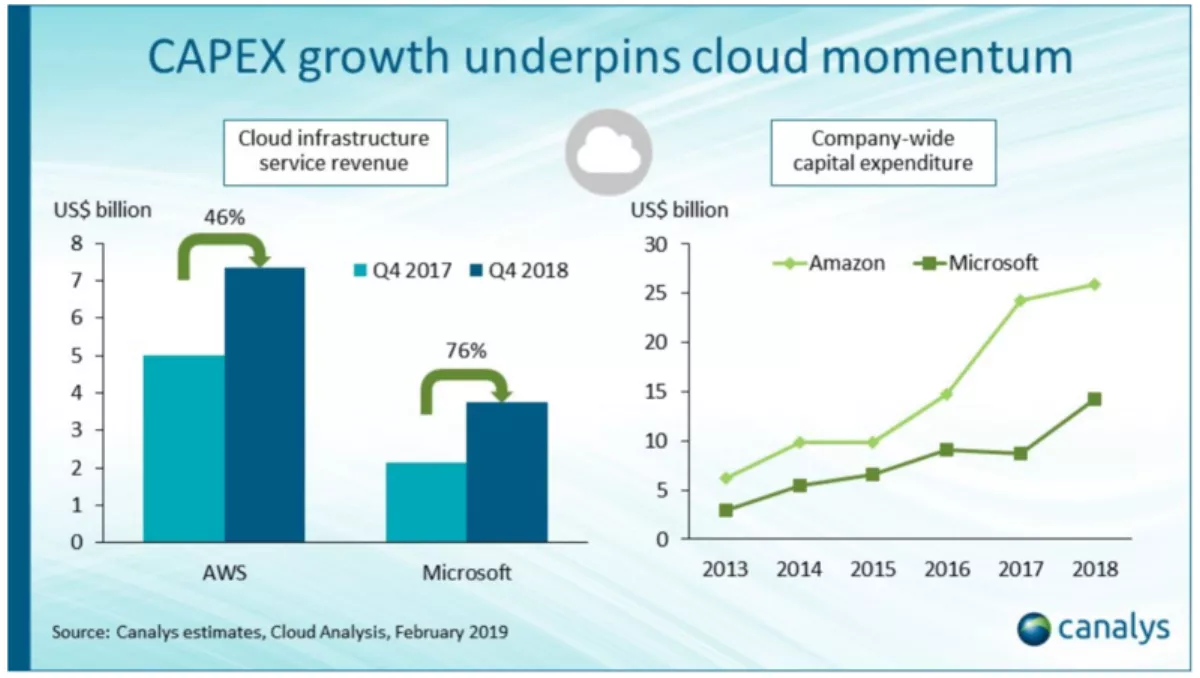

AWS grew 46 percent to reach US$7 billion in the latest quarter. While Microsoft Azure had a significantly higher growth rate with 76 percent, it is still somewhat further back in second place with $4 billion.

Canalys research analyst Daniel Liu says fuelling this growth is the massive infrastructure investments both companies are involved with to expand their global coverage and refresh existing data centers.

“2018 was another year of rapid growth as businesses accelerated digital transformation projects and workload migration. This is set to continue in 2019, with more customers adopting multi-cloud strategies, including hybrid IT,” says Liu.

“AWS maintained momentum due to traction from its enterprise customers, while Microsoft's progress benefits from its long-standing hybrid IT initiatives, taken up by its existing large base of on-premises customers.

Both companies have made increasingly larger investments in data center infrastructure, with the latest public financial reports from Amazon and Microsoft revealing their company-wide capital expenditure (CAPEX) continued to rise annually.

These CAPEX numbers are not exclusively allocated to cloud, but also to investment activities like the purchase of property and equipment or facility assets.

In regards to where the companies currently stand, AWS has 60 cloud infrastructure locations around the globe, with another 12 in the works in Bahrain, Hong Kong, Italy, and South Africa. These investments brought Amazon's CAPEX spend to reach $26 billion in 2018, with the rate of growth slowing slightly to seven percent year-on-year.

Meanwhile, Microsoft's CAPEX reached $14 billion, an increase of 64 percent. It has 54 cloud regions worldwide with another 10 to be launched across Western Europe and Africa.

Liu says the growing need for data sovereignty, lower latency, and higher performance – not to mention competition – are all major factors in driving cloud providers to increase infrastructure investment and bring data centers closer to customers.

“The investment needed to build new interconnected cloud data centers is huge, and due to the constant pressure to optimise data center operating costs, refresh cycles are shorter as they drive innovation,” says Liu.

“Cloud providers are under pressure to be profitable and have to manage CAPEX. The signs are they are currently focusing more on capacity utilisation, which will be reflected in their CAPEX numbers in the first half of 2019. This will impact infrastructure and component suppliers in the short term.