Ongoing trade tensions around the world among other head and tailwinds are set to negatively impact spending on information and communications technology (ICT).

According to IDC, a softening global economy over the next five years will result in increasing pressure on the ability of organisations to up technology budgets while their growth and competitiveness increasingly becomes reliant on digital transformation, artificial intelligence (AI), and data analytics.

However, the market will still experience steady growth as IDC expects spending on hardware, software, services, and telecommunications to reach US$4.6 trillion by 2022 with an average growth rate of 4 percent per year.

Of this, commercial customers will make up approximately 63.5 percent of total spending by 2022 with $2.9 trillion, while consumers will account for the remaining 36.5 percent with $1.7 trillion. IDC expects consumer spending growth to lag behind business and government spending due to the increasing saturation of smartphones and tablets.

The fastest growth over the forecast period is set to be claimed by professional services - which includes cloud and digital service providers - with a growth rate of 7 percent, gaining a rapidly increasing share of overall tech spending thanks in large part to the explosive growth of cloud infrastructure providers.

Nipping on its heels will be media with a 6 percent growth rate, and banking, manufacturing, and retail all with 5 percent. The slowest growing commercial technology budget will be claimed by federal government, followed by wholesale and construction firms.

"In the short term, the trade war between the US and China continues to add volatility to the outlook," says IDC Customer Insights - Analysis vice president Stephen Minton.

"Some firms are also facing the double whammy of weaker sales in China, an increasingly important export market for the manufacturing industry. Meanwhile, the impact in China itself could persist over a longer period of time, with manufacturing and financial services firms being the most exposed."

According to Minton, the US-China trade war is a ‘double-edged sword' for Asia Pacific (APAC).

Many businesses are increasingly dependent on China for revenue and may now be expected to continue their pivot away from the US in trading relationships. However, on the other hand, the conflict opens up opportunities to increase exports to the US market.

"The trade war undoubtedly presents opportunities for India's manufacturing sector," says IDC Customer Insights - Analyst APAC Ashutosh Bisht.

"Many firms in Asia, however, will be forced to try and balance their relationship with both the U.S. and China, and will mostly suffer negatively from any escalation."

Countering negative sentiment around the economy in China is increasing demand for ICT solutions related to digital transformation, which is driving major investments by large enterprise and state-owned customers in industries like retail, manufacturing, healthcare, and financial services - particularly in cloud and AI.

According to IDC Customer Insights - Analysis Western Europe Andrea Minonne, the same is true for technology budgets in Europe.

"Companies in Western Europe are not only looking to embrace new technologies like AI and robotics to improve their business processes, but also adopting more customer-centric approaches to IT spending decisions," says Minonne.

"This is especially true in customer-facing industries like retail, banking, transportation, and telecommunications."

Overall growth rates in Western Europe will slightly lag behind the emerging markets in APAC over the forecast period, but it's the US market that is set to post some of the strongest growth rates despite its relative maturity.

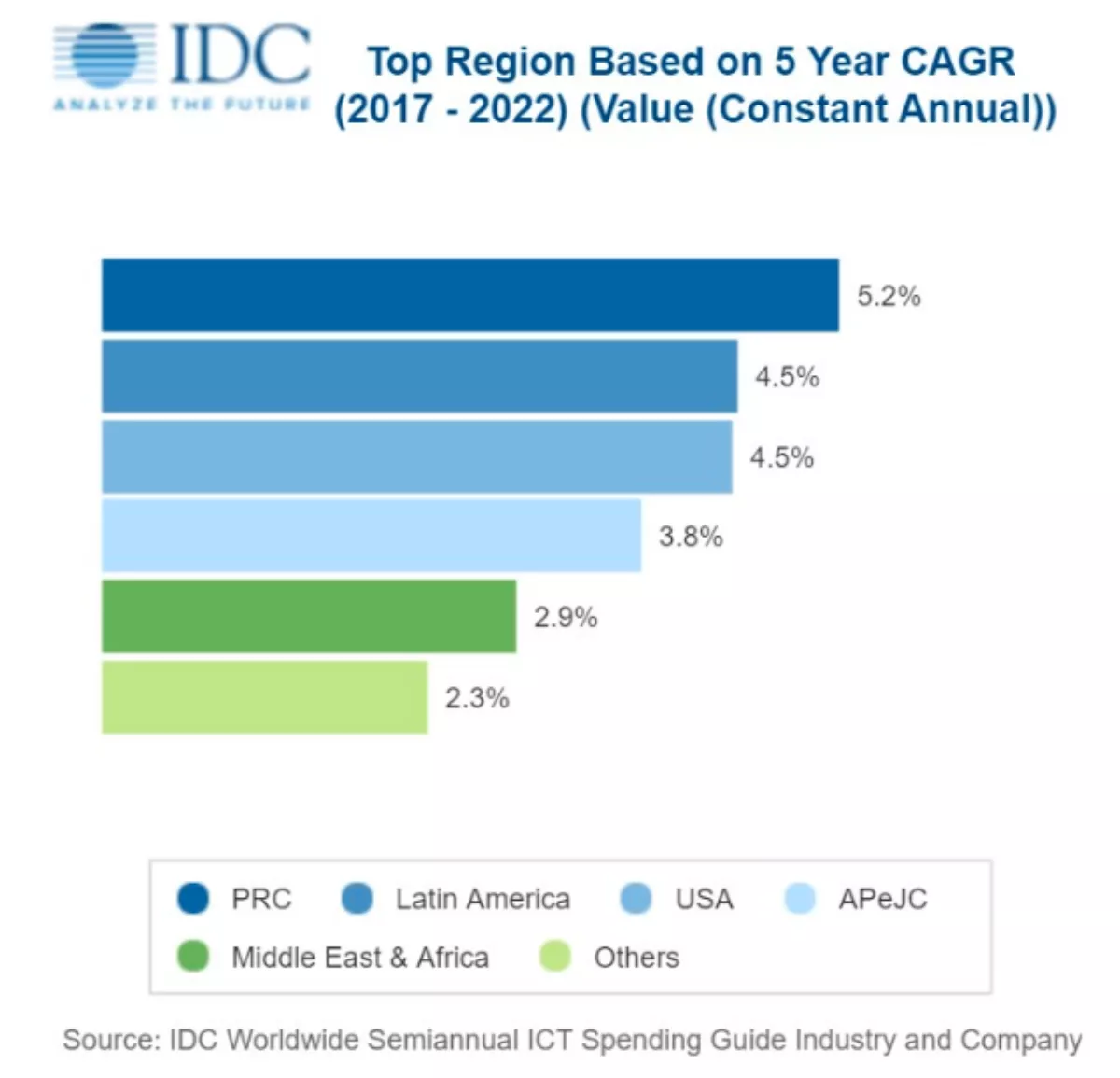

Business investments in digital transformation, cloud, and AI will help drive overall US growth of 4.5 percent over the forecast, equaling Latin America as the second fastest growing region for total ICT spending after China.

"In the US, the professional services industry is expected to continue with strong technology growth and investments. The appetite for cloud-based delivery, new apps, and tech-fueled services show no signs of slowing, and thus we are optimistic about the growth opportunity for this industry," says IDC Customer Insights and Analysis vice president Jessica Goepfert.

"Consumer-driven industries such as retail and hospitality are benefitting from higher wages and disposable incomes. In response, firms in this space are working to develop and deliver unforgettable customer interactions. This takes shape as customisable experiences and infusing technology into their operations. For instance, hotels are implementing technology in guest rooms that can be controlled by mobile apps."