The worldwide Ethernet switch market (Layer 2/3) recorded revenues of $7.07 billion in the second quarter of 2019 (2Q19), an increase of 4.8% year over year.

Meanwhile, worldwide total enterprise and service provider (SP) router market revenues grew 3.4% year over year in 2Q19 to $3.96 billion.

These market results were published today in the International Data Corporation (IDC) Worldwide Quarterly Ethernet Switch Tracker and Worldwide Quarterly Router Tracker.

The Asia/Pacific (excluding Japan) (APeJ) region fell 4.2% year over year.

China's market declined 4.7% year over year while Australia's market dropped 16.0%.

"Network transformation remains a top priority for enterprises around the globe as they look to expand their businesses and delight customers with agile connectivity," says IDC network infrastructure vice president Rohit Mehra.

"Increasingly, organisations are realizing the critical role modernizing the network plays in creating a digital business, which will continue to drive growth in the Ethernet switching and enterprise router platforms into the foreseeable future."

Growth in the Ethernet switch market continues to be driven by the highest-speed switching platforms in the market.

For example, port shipments for 100Gb switches rose 58.3% year over year to 4.4 million. 100Gb revenues grew 42.9% year over year in 2Q19 to $1.28 billion, making up 18.1% of the market's revenue, compared to 13.2% of the market's revenue a year earlier.

25Gb switches also saw impressive growth, increasing 84.8% to $364.1 million, with port shipments growing 74.5% year over year.

Lower-speed campus switches, a more mature part of the market, continue to see moderate growth.

10Gb port shipments rose 2.6% year over year, to make up 27.9% of the market's revenue.

1Gb switches grew 6.6% year over year in port shipments, making up 40.0% of the market's total revenues.

The worldwide enterprise and service provider router market grew 3.4% on a year-over-year basis in 2Q19, with the major service provider segment, which accounts for 75.9% of revenues, increasing 2.0% and the enterprise segment of the market growing a healthy 8.0%.

The combined service provider and enterprise router market increased by 2.7% in APeJ, with the service provider segment increasing 3.8%.

Vendor Highlights

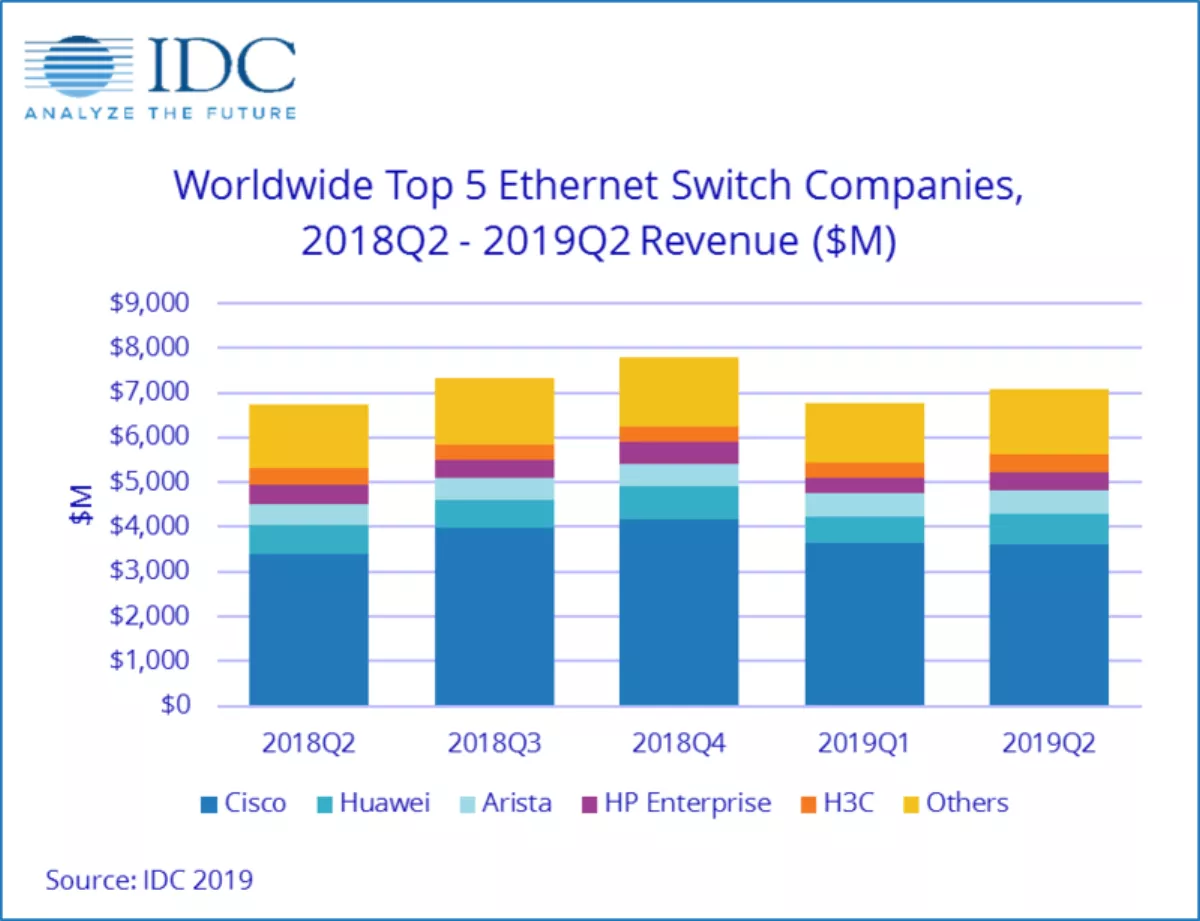

Cisco finished 2Q19 with a 6.8% year-over-year increase in overall Ethernet switch revenues and market share of 51.1%.

In the hotly contested 25Gb/100Gb segment, Cisco is the market leader with 38.8% of the market's revenue.

Cisco's campus/branch Ethernet switch revenue increased 14.3% year over year. Meanwhile, Cisco's data center switching revenue declined 3.2% year over year in 2Q19.

The company's combined service provider and enterprise router revenue rose 6.6% year over year, with enterprise router revenue increasing 16.2% and SP revenues growing 1.1%. Cisco's combined SP and enterprise router market share increased to 36.8%, up from 35.7% in 2Q18.

Huawei's Ethernet switch revenue rose 18.9% on an annualised basis, giving the company market share of 9.7%. The company's combined SP and enterprise router revenue rose 1.5% year over year with a market share of 31.1%.

Arista Networks saw Ethernet switch revenues increase 15.4% in 2Q19, bringing its share to 7.3% of the total market, up from 6.6% a year earlier. 100Gb revenues accounted for 65.4% of the company's total revenue, indicating the company's focus on hyperscale and cloud providers and select large enterprise segments.

HPE's Ethernet switch revenue declined 6.3% year over year, giving the company a market share of 5.8%.

Juniper's Ethernet switch revenue declined 19.6% in 2Q19, bringing its market share to 2.9%. Juniper saw a 15.0% decline in combined enterprise and SP router sales, bringing its market share in the router market to 10.5%.

"The dynamics of both the Ethernet switching and the router markets continue to evolve," says IDC networking trackers research director Petr Jirovsky.

"The Ethernet switch market continues to see its most robust growth from the highest-speed switching platforms, led by the continued build-out of data center capacity by hyper-scale and cloud service providers. The router market, meanwhile, is being driven by enterprises looking to connect to an increasing array of applications in conjunction with SD-WAN at the edge of their networks. Both these trends are in varying degrees of maturity around the globe, but they will combine to continue to drive these markets into the coming years."

The IDC Quarterly Ethernet Switch Tracker and the Quarterly Router Tracker provide total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format.

The Ethernet switch market is segmented by speed (100Mb, 1000Mb, 10Gb, 25Gb, 40Gb, 50Gb, 100Gb), product (fixed managed, fixed unmanaged, modular), and layer (L2, L3, ADC).

Measurement for the Ethernet switch market is provided in vendor revenue, value, and port shipments.

The router market is further split by product (high-end, mid-range, low-end, SOHO), deployment (service provider, enterprise), connectivity (core, edge), and the measurements are in vendor revenue, value, and unit shipments.